Back to Case Studies

Back to Case Studies

Location

New York, NY

The Upsolve App helps low-income families and individuals who cannot afford lawyers file for bankruptcy for free. In many cases, filing for Chapter 7 bankruptcy can be an efficient way to eliminate debt. Paradoxically, filing for bankruptcy is expensive to do - it can cost up to $1,300 in fees, a significant burden for people who are already struggling financially. In addition to the exorbitant fees, the filing process can be confusing and complicated to navigate alone. Resulting filing errors can be costly to fix. Upsolve simplifies and accelerates the bankruptcy filing process by walking people through the necessary steps with an online web app that is simple and easy to use. The app allows the user to easily generate and complete the bankruptcy forms required to alleviate debt. Upsolve, a non-profit, is not predatory and simply helps users successfully navigate a time in their lives that can feel challenging, frustrating, and isolating. Upsolve is working towards becoming the defining brand in America for low-income families in financial distress who need access to their legal and financial rights.

Millions of low-income families and individuals are trapped in debt due to medical issues, job loss, or other crises. The COVID-19 pandemic has exacerbated the financial challenges that many families were already facing. According to consumer credit reporting company Experian, in 2020, the U.S. consumer debt balance increased by 6% – the highest annual growth recorded in over 10 years.1 In many cases, this debt has pushed people over the edge to the point where filing for bankruptcy is one of the few steps that they can take to help them regain control of their financial lives. Filing for bankruptcy allows families and individuals to wipe out certain kinds of debt. For some, filing for bankruptcy can even prevent evictions, foreclosures, or repossessions. Filing can help people restart with a clean slate and provide necessary financial relief.

In 2020 The Upsolve App was named one of TIME magazine’s 100 Best Inventions that make the world a better place.

In 2020 The Upsolve App was named one of TIME magazine’s 100 Best Inventions that make the world a better place.

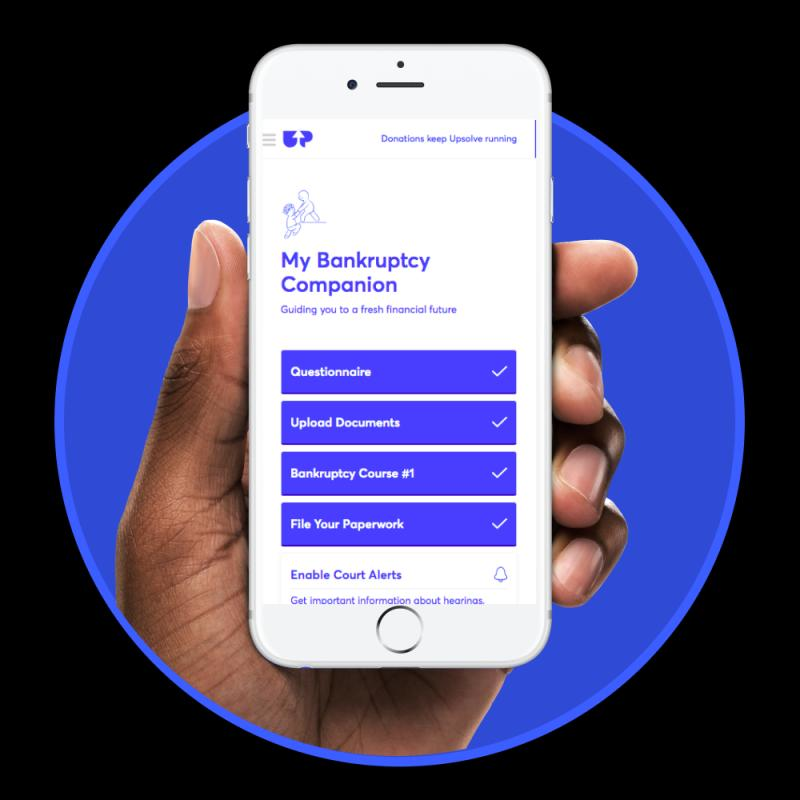

The Upsolve App, also known as the “Chapter 7 bankruptcy tool,” walks people through how to complete the necessary forms to file for bankruptcy. Users can easily navigate through the necessary steps to file, get access to frequently asked questions, and are invited to join a community of people who discuss bankruptcy-related topics and support one another with tips and advice. The app is designed to spread positivity and encourage users to regain control of their financials. For example, the app has cheerful graphics that inform users that famous individuals like Walt Disney and Henry Ford also filed

for bankruptcy at some point in their lives, and then went on to achieve great things. Many Upsolve users have become trapped in debt because of various personal and family crises including unexpected medical expenses or natural disasters that affected family businesses. These same users have leveraged the Upsolve App on their path back to financial security, new careers, and improved livelihoods.

Nearly 7,000 people have confirmed filing for bankruptcy with the Upsolve app, helping to alleviate over $300M in debt. In addition, Upsolve has educated over 2.5 million people about their legal and financial rights through free bankruptcy-related education on the Upsolve website. As of April 2021, Upsolve has150,000+ members.

In 2020 The Upsolve App was named one of TIME magazine’s 100 Best Inventions that make the world a better place.

¹ Stefan Lembo Stolba, “Average U.S. Consumer Debt Reaches New Record in 2020,” Experian, April 6, 2021, https://www.experian.com/blogs/ask-experian/research/consumer-debt-study/. ↩